The Many Ways to Refinance

There are many refinancing options available to you. A lower interest rate is just one of the things to consider when you refinance, but it is key to saving money, so let’s start with that.

A lower interest rate

If you still haven’t taken a good look at an amortization calculator, it’s an eye-opening exercise: watch as a lower interest rate drops your monthly payment and saves tens of thousands of dollars over the life of the loan.

For example, on a 30-year, $200,000 loan, a single percentage point can save $40,000:

$200,000 @ 4.5% = $1,013 monthly payment, $164,813 in interest total

$200,000 @ 3.5% = $898 monthly payment, $123,312 in interest total

Pretty compelling!

No more MIP

Is your first mortgage an FHA-backed loan? Then you know that one of the trade-offs was a mortgage insurance premium (MIP), which is usually required for the life of the loan. The only way to get rid of that monthly burden is to refinance into a conventional mortgage, and it can definitely be worth doing. PennyMac has good info on the pros and cons of making the switch.

A shorter term

You’ll build equity faster, pay off your mortgage sooner, and save a ton on interest. Fifteen and 20-year terms are common; the shorter the term, the lower the rate.

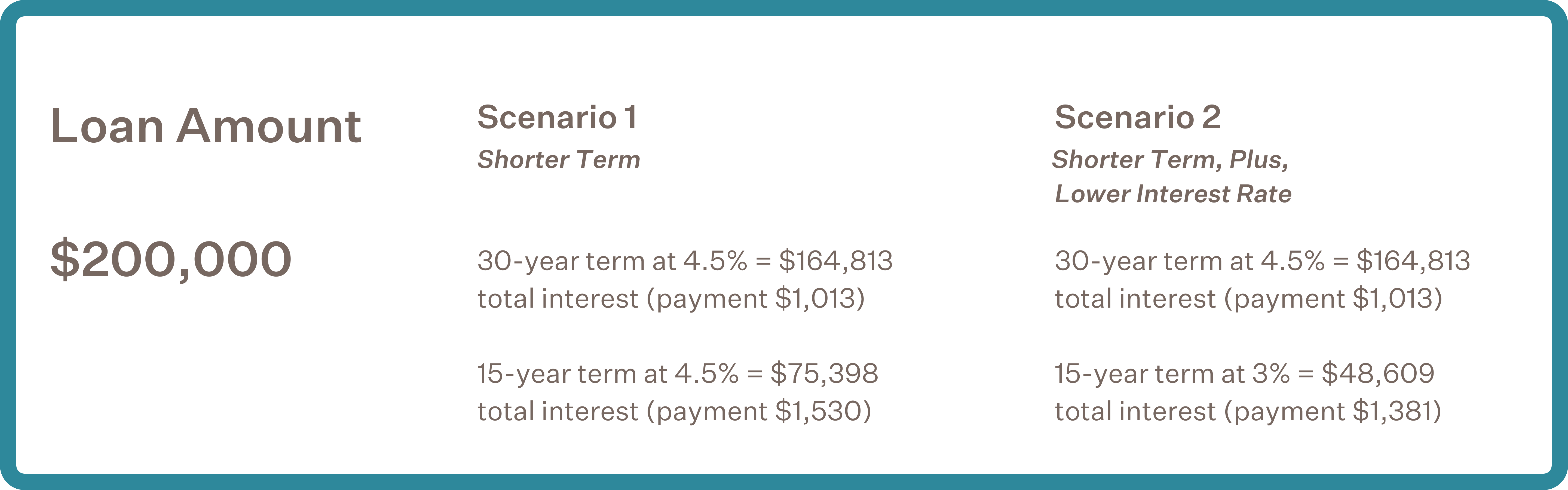

First, let’s take a look at these two scenarios below.

You can see how a shorter term alone will save you a huge amount of interest, but at the cost of a much higher monthly payment. Combine a shorter term and a lower interest rate, and you save even more, with a more manageable payment.

Refi to prepay

The problem with a shorter term is higher monthly payments. You have less flexibility if money gets tight. Alternative: you take a lower rate, but not a shorter term. Then, instead of pocketing the monthly savings, you keep making the same mortgage payment, i.e. you make extra payments on principal (ask your loan servicer about the best way to do that).

You don’t get the extra-low rate of a shorter term, but you still pay much less interest and get ahead faster — without being bound to the bigger payment.

Take the earlier example: refinancing from 4.5 percent to 3.5 percent on a $200,000 loan. The lower interest rate drops your monthly payment from $1,013 to $898, a savings of $115 per month. If you put that $115 toward principal every month, you’ll pay off your mortgage more than five years early.

A fixed rate

If you went with an adjustable-rate mortgage when you bought your house, you’ll probably want to refinance and lock in a fixed rate a few months before your rate is set to go up.

Cash-out

A “cash-out” refi is a way to extract all or part of any equity you’ve built up. The new loan is enough to pay off your old mortgage, plus any closing costs, and leave you with some cash.

However, just as with a home equity loan (see “Home Equity”), we recommend exploring other options first. Do you really want to wipe out your equity? Is whatever you want that cash for worth the risk of using your home as collateral? Plus, cashing out could increase your loan-to-value ratio and force you to buy mortgage insurance, or pay more for it.

Cash-in

You can also add to your equity when you refinance. In other words, make a big payment on principal. It’s another way to lower your monthly payments (maybe enough to do a shorter term or refi to prepay) and save on interest.

Some lenders offer a cash-in alternative that lets you lower your monthly payment without the hassle or expense of refinancing. It’s called “recasting” or “re-amortizing” (FHA and VA loans aren’t eligible). You still put a chunk of money toward principal —minimums vary — but your interest rate and loan term stay the same. The fee for doing this is far less than for a refi, as little as $250. Lenders rarely advertise recasting, so you’ll have to ask about it.