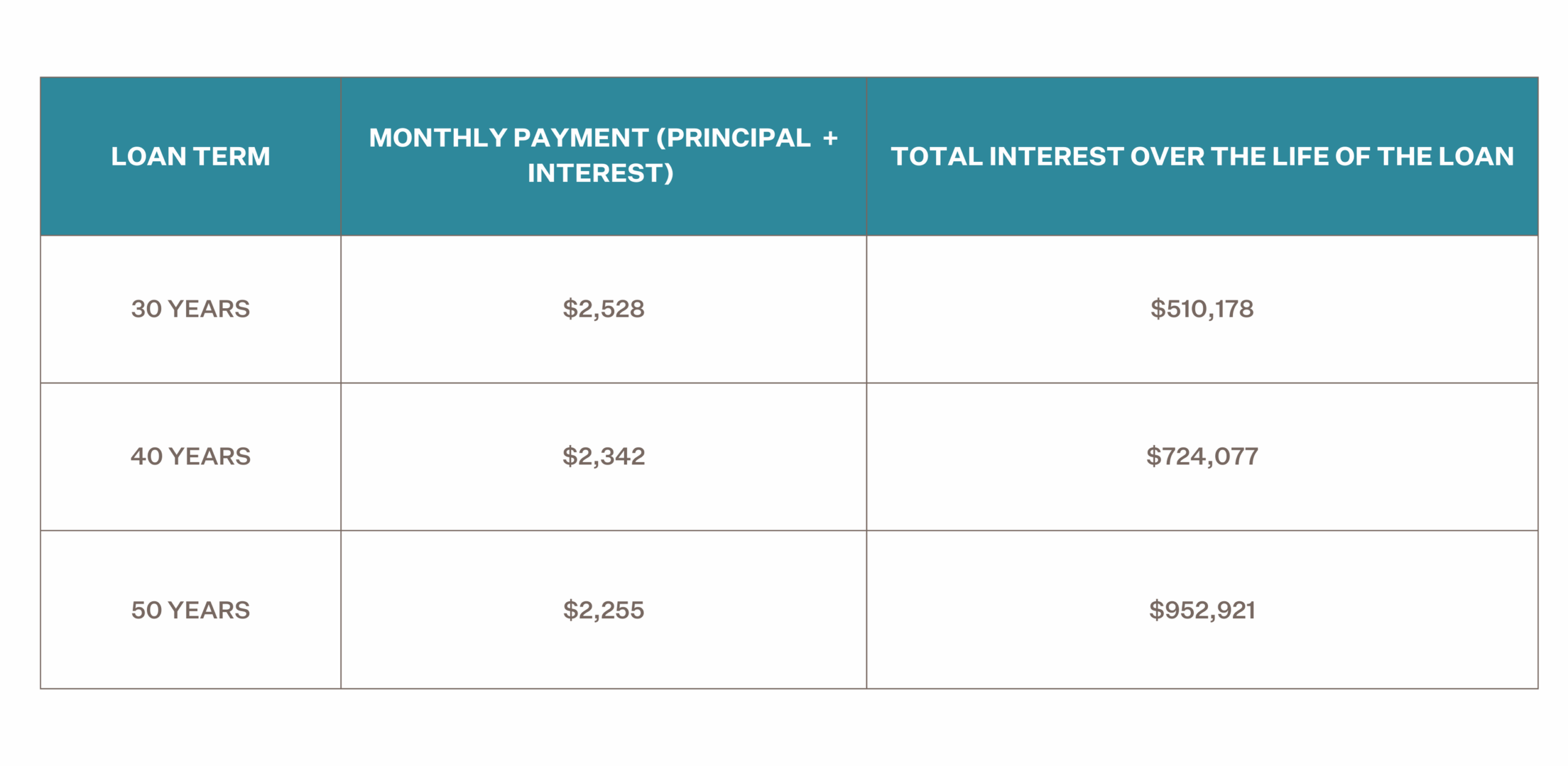

That’s about $273 less per month for the 50-year mortgage compared to a 30-year mortgage, but it costs $442,743 more (nearly double) in total interest.

A smaller payment may bring short-term relief, but the total cost of borrowing grows dramatically. And keep in mind this does not include homeowners insurance, property taxes, and HOA fees.

What About PMI (Private Mortgage Insurance)?

If your down payment on a home is less than 20% of the purchase price, you’ll likely pay private mortgage insurance (PMI) until you reach 20% equity.

PMI acts as a safeguard for lenders in case you are unable to repay the loan. Borrower-paid PMI is added to your monthly mortgage payment, typically costing between 0.5% and 1.5%.

Because a 50-year loan pays down principal more slowly, you’ll pay PMI longer — adding even more cost.

Using a 0.8% PMI rate here’s what you can expect to pay just in PMI.

Framework Tip: If you’re considering a smaller down payment, use a mortgage calculator to see how long it will take to reach 20% equity. It may be worth saving a little longer upfront to save thousands later.

The Upside: When a 50-Year Loan Can Help

For some homebuyers and homeowners, the longer term can create meaningful breathing room.

- Lower monthly payments: Stretching out your term spreads costs over more years, freeing up cash flow for savings or other needs.

- Easier qualification: Lower payments can help you meet a lender’s debt-to-income ratio.

- Flexibility in high-cost markets: A longer term might make it possible to buy or refinance in areas where prices feel out of reach.

If you expect to refinance or move within the next decade, a 50-year loan could make sense as a temporary bridge.

The Tradeoffs: What to Consider Carefully

Every mortgage term comes with tradeoffs. The key is understanding which ones align with your goals.

- Higher total interest: You’ll pay significantly more over time.

- Slower equity growth: It takes longer to build ownership in your home.

- Extended PMI: You may pay mortgage insurance for many more years.

- Longer debt horizon: You could still have a mortgage into retirement.

Framework Tip: If your main goal is to grow long-term wealth, a 30-year loan, or making extra payments on a longer loan, will help you build equity faster.

For Current Homeowners: Considering a Refinance

If you already own a home, refinancing into a 50-year loan can lower your monthly payment, but it also resets your amortization clock.

That means starting over on interest and building equity more slowly again. Your monthly payments will begin to pay more towards your interest than your principal.

Before extending your term, consider:

- Or a shorter refinance term that balances monthly relief with long-term value

These options can create flexibility without decades of new debt.

Is a 50-Year Mortgage for You?

A 50-year mortgage isn’t inherently good or bad. It’s simply one option among many.

The best choice depends on your priorities:

- Are you focused on making your budget work right now?

- Or on building wealth and stability over time?

A 50-year mortgage can be helpful if:

- Your budget is tight and you need lower payments now

- You expect your income to grow

- You plan to refinance later

- You need short-term relief from monthly expenses

It can also support older homeowners who want:

- Maximum cashflow flexibility

- To stay in their home longer without pressure

But it’s not the cheapest way to borrow money. And it slows your equity.

When you understand the tradeoffs, you can make choices that align with your goals and values and that’s how homeownership becomes sustainable.

Framework Tip: If you’re thinking about buying or refinancing, run the numbers using a trusted mortgage calculator. Compare a 30-, 40-, and 50-year term side by side. Seeing how total interest and equity change over time can help you choose the path that feels right — and keeps you steady for the long run.